Data Science

Contents

- 1 Social Media Sentiment Analysis

- 2 Remote development

- 2.1 Eclipse - Connect to a remote file system

- 2.2 Mount a remote filesystem in your local machine

- 2.3 Git and GitHub

- 2.3.1 Installing Git

- 2.3.2 Configuring GitHub

- 2.3.3 Creating a local repository

- 2.3.4 Creating a README file to describe the repository

- 2.3.5 Adding repository files to an index

- 2.3.6 Committing changes made to the index

- 2.3.7 Creating a repository on GitHub

- 2.3.8 Pushing files in local repository to GitHub repository

- 2.3.9 GUI Clients

- 3 Anaconda

- 4 Cursos

- 5 R programming language

- 6 Data Mining with R - Luis Torgo

- 7 Text Mining with R - A TIDY APPROACH, Julia Silge & David Robinson

- 8 RapidMiner

- 9 Fake news detection

Social Media Sentiment Analysis

https://www.dezyre.com/article/top-10-machine-learning-projects-for-beginners/397

https://elitedatascience.com/machine-learning-projects-for-beginners#social-media

https://en.wikipedia.org/wiki/Sentiment_analysis

https://en.wikipedia.org/wiki/Social_media_mining

Remote development

Eclipse - Connect to a remote file system

https://us.informatiweb.net/tutorials/it/6-web/148--eclipse-connect-to-a-remote-file-system.html

Mount a remote filesystem in your local machine

https://stackoverflow.com/questions/32747819/remote-java-development-using-intellij-or-eclipse

https://serverfault.com/questions/306796/sshfs-problem-when-losing-connection

https://askubuntu.com/questions/358906/sshfs-messes-up-everything-if-i-lose-connection

https://askubuntu.com/questions/716612/sshfs-auto-reconnect

root@sinfronteras.ws: /home/adelo/1-system/3-cloud

sshfs -o reconnect,ServerAliveInterval=5,ServerAliveCountMax=3 root@sinfronteras.ws: /home/adelo/1-system/3-cloud

sshfs -o allow_other root@sinfronteras.ws: /home/adelo/1-system/3-cloud

faster way to mount a remote file system than sshfs:

https://superuser.com/questions/344255/faster-way-to-mount-a-remote-file-system-than-sshfs

Git and GitHub

Installing Git

https://www.digitalocean.com/community/tutorials/how-to-install-git-on-ubuntu-18-04

sudo apt install git

Configuring GitHub

https://www.howtoforge.com/tutorial/install-git-and-github-on-ubuntu/

We need to set up the configuration details of the GitHub user. To do this use the following two commands by replacing "user_name" with your GitHub username and replacing "email_id" with your email-id you used to create your GitHub account.

git config --global user.name "user_name" git config --global user.email "email_id"

git config --global user.name "adeloaleman" git config --global user.email "adeloaleman@gmail.com"

Creating a local repository

git init /home/adelo/1-system/1-disco_local/1-mis_archivos/1-pe/1-ciencia/1-computacion/1-programacion/GitHubLocalRepository

Creating a README file to describe the repository

Now create a README file and enter some text like "this is a git setup on Linux". The README file is generally used to describe what the repository contains or what the project is all about. Example:

vi README

This is Adelo's git repo

Adding repository files to an index

This is an important step. Here we add all the things that need to be pushed onto the website into an index. These things might be the text files or programs that you might add for the first time into the repository or it could be adding a file that already exists but with some changes (a newer version/updated version).

Here we already have the README file. So, let's create another file which contains a simple C program and call it sample.c. The contents of it will be:

vi sample.c

#include<stdio.h>

int main()

{

printf("hello world");

return 0;

}

So, now that we have 2 files:

README and sample.c

add it to the index by using the following 2 commands:

git add README git add smaple.c

Note that the "git add" command can be used to add any number of files and folders to the index. Here, when I say index, what I am referring to is a buffer like space that stores the files/folders that have to be added into the Git repository.

Committing changes made to the index

Once all the files are added, we can commit it. This means that we have finalized what additions and/or changes have to be made and they are now ready to be uploaded to our repository. Use the command:

git commit -m "some_message"

"some_message" in the above command can be any simple message like "my first commit" or "edit in readme", etc.

Creating a repository on GitHub

Create a repository on GitHub. Notice that the name of the repository should be the same as the repository's on the local system. In this case, it will be "Mytest". To do this login to your account on https://github.com. Then click on the "plus(+)" symbol at the top right corner of the page and select "create new repository". Fill the details as shown in the image below and click on "create repository" button.

Once this is created, we can push the contents of the local repository onto the GitHub repository in your profile. Connect to the repository on GitHub using the command:

git remote add origin https://github.com/adeloaleman/GitHubLocalRepository

Pushing files in local repository to GitHub repository

The final step is to push the local repository contents into the remote host repository (GitHub), by using the command:

git push origin master

GUI Clients

Git comes with built-in GUI tools for committing (git-gui) and browsing (gitk), but there are several third-party tools for users looking for platform-specific experience.

Parece que la aplicación oficial GitHub Desktop no está disponible para Ubuntu. Entonces hay otras aplicaciones similares disponibles para Linux: https://git-scm.com/download/gui/linux

He instalado ésta: https://www.gitkraken.com/

Anaconda

Anaconda is a free and open source distribution of the Python and R programming languages for data science and machine learning related applications (large-scale data processing, predictive analytics, scientific computing), that aims to simplify package management and deployment. Package versions are managed by the package management system conda. https://en.wikipedia.org/wiki/Anaconda_(Python_distribution)

Installation

https://www.anaconda.com/download/#linux

https://linuxize.com/post/how-to-install-anaconda-on-ubuntu-18-04/

Jupyter Notebook

https://www.datacamp.com/community/tutorials/tutorial-jupyter-notebook

Cursos

eu.udacity.com

https://classroom.udacity.com/courses/ud120

www.coursera.org

https://www.coursera.org/learn/machine-learning/home/welcome

Otros

https://www.udemy.com/machine-learning-course-with-python/

https://stackoverflow.com/questions/19181999/how-to-create-a-keyboard-shortcut-for-sublimerepl

R programming language

The R Project for Statistical Computing: https://www.r-project.org/

R is an open-source programming language that specializes in statistical computing and graphics. Supported by the R Foundation for Statistical Computing, it is widely used for developing statistical software and performing data analysis.

Installing R on Ubuntu 18.04

https://www.digitalocean.com/community/tutorials/how-to-install-r-on-ubuntu-18-04

Because R is a fast-moving project, the latest stable version isn’t always available from Ubuntu’s repositories, so we’ll start by adding the external repository maintained by CRAN.

Let’s first add the relevant GPG key:

sudo apt-key adv --keyserver keyserver.ubuntu.com --recv-keys E298A3A825C0D65DFD57CBB651716619E084DAB9

Once we have the trusted key, we can add the repository: (Note that if you’re not using 18.04, you can find the relevant repository from the R Project Ubuntu list, named for each release)

sudo add-apt-repository 'deb https://cloud.r-project.org/bin/linux/ubuntu bionic-cran35/'

sudo apt update

At this point, we're ready to install R with the following command:

sudo apt install r-base

This confirms that we've successfully installed R and entered its interactive shell:

R sudo -i R

Installing R Packages from CRAN

Part of R’s strength is its available abundance of add-on packages. For demonstration purposes, we'll install txtplot, a library that outputs ASCII graphs that include scatterplot, line plot, density plot, acf and bar charts. We'll start R as root so that the libraries will be available to all users automatically:

sudo -i R

> install.packages('txtplot')

When the installation is complete, we can load txtplot:

> library('txtplot')

If there are no error messages, the library has successfully loaded. Let’s put it in action now with an example which demonstrates a basic plotting function with axis labels. The example data, supplied by R's datasets package, contains the speed of cars and the distance required to stop based on data from the 1920s:

> txtplot(cars[,1], cars[,2], xlab = 'speed', ylab = 'distance')

+----+-----------+------------+-----------+-----------+--+

120 + * +

| |

d 100 + * +

i | * * |

s 80 + * * +

t | * * * * |

a 60 + * * * * * +

n | * * * * * |

c 40 + * * * * * * * +

e | * * * * * * * |

20 + * * * * * +

| * * * |

0 +----+-----------+------------+-----------+-----------+--+

5 10 15 20 25

speed

If you are interested to learn more about txtplot, use help(txtplot) from within the R interpreter.

Package that provides functions to connect to MySQL databases

This package name is RMySQL. You just need to type the following command at R prompt:

> install.packages('RMySQL')

Package manager

Display packages currently installed in your computer:

> installed.packages()

This produces a long output with each line containing a package, its version information, the packages it depends, and so on.

A more user-friendly, although less complete, list of the installed packages can be obtained by issuing:

> library()

The following command can be very useful as it allows you to check whether there are newer versions of your installed packages at CRAN:

> old.packages()

Moreover, you can use the following command to update all your installed packages:

> update.packages()

Data Mining with R - Luis Torgo

http://www.dcc.fc.up.pt/~ltorgo/DataMiningWithR/

The book is accompanied by a set of freely available R source files that can be obtained at the book's Web site. These files include all the code used in the case studies. They facilitate the "do-it-yourself" approach followed in this book. All data used in the case studies is available at the book's Web site as well. Moreover, we have created an R package called DMwR that contains several functions used in the book as well as the datasets already in R format. You should install and load this package to follow the code in the book (details on how to do this are given in the first chapter).

Installing the DMwR package

One thing that you surely should do is install the package associated with this book, which will give you access to several functions used throughout the book as well as datasets. To install it you proceed as with any other package:

Al tratar de instalarlo en Ubuntu 18.04 se generó un error:

Configuration failed because libcurl was not found. Try installing: * deb: libcurl4-openssl-dev (Debian, Ubuntu, etc)

Luego de instalar el paquete mencionado, la instalación completó correctamente:

> install.packages('DMwR')

Chapter 3 - Predicting Stock Market Returns

We will address some of the difficulties of incorporating data mining tools and techniques into a concrete business problem. The spe- cific domain used to illustrate these problems is that of automatic «stock trading systems» (sistemas de comercio de acciones). We will address the task of building a stock trading system based on prediction models obtained with daily stock quotes data. Several models will be tried with the goal of predicting the future returns of the S&P 500 market index (The Standard & Poor's 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ). These predictions will be used together with a trading strategy to reach a decision regarding the market orders to generate.

This chapter addresses several new data mining issues, among which are

- How to use R to analyze data stored in a database,

- How to handle prediction problems with a time ordering among data observations (also known as time series), and

- An example of the difficulties of translating model predictions into decisions and actions in real-world applications.

The Available Data

In our case study we will concentrate on trading the S&P 500 market index. Daily data concerning the quotes of this security are freely available in many places, for example, the Yahoo finance site (http://finance.yahoo.com)

The data we will use is available through different methods:

- Reading the data from the book R package (DMwR).

- The data (in two alternative formats) is also available at http://www.dcc.fc.up.pt/~ltorgo/DataMiningWithR/datasets3.html

- The first format is a comma separated values (CSV) file that can be read into R in the same way as the data used in Chapter 2.

- The other format is a MySQL database dump file that we can use to create a database with the S&P 500 quotes in MySQL.

- Getting the Data directly from the Web (from Yahoo finance site, for example). If you choose to follow this path, you should remember that you will probably be using a larger dataset than the one used in the analysis carried out in this book. Whichever source you choose to use, the daily stock quotes data includes information regarding the following properties:

- Date of the stock exchange session

- Open price at the beginning of the session

- Highest price during the session

- Lowest price

- Closing price of the session

- Volume of transactions

- Adjusted close price4

It is up to you to decide which alternative you will use to get the data. The remainder of the chapter (i.e., the analysis after reading the data) is independent of the storage schema you decide to use.

Reading the data from the DMwR package

La data se encuentra cargada en el paquete DMwR. So, after installing the package DMwR, it is enough to issue:

> library(DMwR) > data(GSPC)

The first statement is only required if you have not issued it before in your R session. The second instruction will load an object, GSPC, of class xts. You can manipulate it as if it were a matrix or a data frame. Try, for example:

> head(GSPC)

Open High Low Close Volume Adjusted

1970-01-02 92.06 93.54 91.79 93.00 8050000 93.00

1970-01-05 93.00 94.25 92.53 93.46 11490000 93.46

1970-01-06 93.46 93.81 92.13 92.82 11460000 92.82

1970-01-07 92.82 93.38 91.93 92.63 10010000 92.63

1970-01-08 92.63 93.47 91.99 92.68 10670000 92.68

1970-01-09 92.68 93.25 91.82 92.40 9380000 92.40

Reading the Data from the CSV File

Reading the Data from a MySQL Database

Getting the Data directly from the Web

Handling Time-Dependent Data in R

The data available for this case study depends on time. This means that each observation of our dataset has a time tag attached to it. This type of data is frequently known as time series data. The main distinguishing feature of this kind of data is that order between cases matters, due to their attached time tags. Generally speaking, a time series is a set of ordered observations of a variable :

where is the value of the series variable at time .

The main goal of time series analysis is to obtain a model based on past observations of the variable, , which allows us to make predictions regarding future observations of the variable, . In the case of our stocks data, we have what is usually known as a multivariate time series, because we measure several variables at the same time tags, namely the Open, High, Low, Close, Volume, and AdjClose.

R has several packages devoted to the analysis of this type of data, and in effect it has special classes of objects that are used to store type-dependent data. Moreover, R has many functions tuned for this type of objects, like special plotting functions, etc.

Among the most flexible R packages for handling time-dependent data are:

- zoo (Zeileis and Grothendieck, 2005) and

- xts (Ryan and Ulrich, 2010).

Both offer similar power, although xts provides a set of extra facilities (e.g., in terms of sub-setting using ISO 8601 time strings) to handle this type of data.

In technical terms the class xts extends the class zoo, which means that any xts object is also a zoo object, and thus we can apply any method designed for zoo objects to xts objects. We will base our analysis in this chapter primarily on xts objects.

To install «zoo» and «xts» in R:

install.packages('zoo')

install.packages('xts')

The following examples illustrate how to create objects of class xts:

1 > library(xts)

2 > x1 <- xts(rnorm(100), seq(as.POSIXct("2000-01-01"), len = 100, by = "day"))

3 > x1[1:5]

> x2 <- xts(rnorm(100), seq(as.POSIXct("2000-01-01 13:00"), len = 100, by = "min"))

> x2[1:4]

> x3 <- xts(rnorm(3), as.Date(c("2005-01-01", "2005-01-10", "2005-01-12")))

> x3

The function xts() receives the time series data in the first argument. This can either be a vector, or a matrix if we have a multivariate time series.In the latter case each column of the matrix is interpreted as a variable being sampled at each time tag (i.e., each row). The time tags are provided in the second argument. This needs to be a set of time tags in any of the existing time classes in R. In the examples above we have used two of the most common classes to represent time information in R: the POSIXct/POSIXlt classes and the Date class. There are many functions associated with these objects for manipulating dates information, which you may want to check using the help facilities of R. One such example is the seq() function. We have used this function before to generate sequences of numbers.

As you might observe in the above small examples, the objects may be indexed as if they were “normal” objects without time tags (in this case we see a standard vector sub-setting). Still, we will frequently want to subset these time series objects based on time-related conditions. This can be achieved in several ways with xts objects, as the following small examples try to illustrate:

> x1[as.POSIXct("2000-01-04")]

> x1["2000-01-05"]

> x1["20000105"]

> x1["2000-04"]

x1["2000-02-26/2000-03-03"]

> x1["/20000103"]

Multiple time series can be created in a similar fashion as illustrated below:

> mts.vals <- matrix(round(rnorm(25),2),5,5)

> colnames(mts.vals) <- paste('ts',1:5,sep='')

> mts <- xts(mts.vals,as.POSIXct(c('2003-01-01','2003-01-04', '2003-01-05','2003-01-06','2003-02-16')))

> mts

> mts["2003-01",c("ts2","ts5")]

The functions index() and time() can be used to “extract” the time tags information of any xts object, while the coredata() function obtains the data values of the time series:

> index(mts)

> coredata(mts)

Defining the Prediction Tasks

Generally speaking, our goal is to have good forecasts of the future price of the S&P 500 index so that profitable orders can be placed on time.

What to Predict

The trading strategies we will describe in Section 3.5 assume that we obtain a prediction of the tendency of the market in the next few days. Based on this prediction, we will place orders that will be profitable if the tendency is confirmed in the future.

Let us assume that if the prices vary more than , «we consider this worthwhile in terms of trading (e.g., covering transaction costs)» «consideramos que vale la pena en términos de negociación (por ejemplo, que cubre los costos de transacción)». In this context, we want our prediction models to forecast whether this margin is attainable in the next days.

Please note that within these days we can actually observe prices both above and below this percentage. For instance, the closing price at time may represent a variation much lower than , but it could have been preceded by a period of prices representing variations much higher than within the window

This means that predicting a particular price for a specific future time might not be the best idea. In effect, what we want is to have a prediction of the overall dynamics of the price in the next days, and this is not captured by a particular price at a specific time.

We will describe a variable, calculated with the quotes data, that can be seen as an indicator (a value) of the tendency in the next days. The value of this indicator should be related to the confidence we have that the target margin will be attainable in the next days.

At this stage it is important to note that when we mention a variation in , we mean above or below the current price. The idea is that positive variations will lead us to buy, while negative variations will trigger sell actions. The indicator we are proposing resumes the tendency as a single value, positive for upward tendencies, and negative for downward price tendencies.

Let the daily average price be approximated by:

where , and are the close, high, and low quotes for day , respectively

Let be the set of percentage variations of today's close to the following days average prices (often called arithmetic returns):

Our indicator variable is the total sum of the variations whose absolute value is above our target margin

The general idea of the variable is to signal -days periods that have several days with average daily prices clearly above the target variation. High positive values of mean that there are several average daily prices that are higher than today's close. Such situations are good indications of potential opportunities to issue a buy order, as we have good expectations that the prices will rise. On the other hand, highly negative values of suggest sell actions, given the prices will probably decline. Values around zero can be caused by periods with "flat" prices or by conflicting positive and negative variations that cancel each other. The following function implements this simple indicator:

T.ind <- function(quotes, tgt.margin = 0.025, n.days = 10) {

v <- apply(HLC(quotes), 1, mean)

r <- matrix(NA, ncol = n.days, nrow = NROW(quotes))

for (x in 1:n.days) r[, x] <- Next(Delt(v, k = x), x)

x <- apply(r, 1, function(x) sum(x[x > tgt.margin | x < -tgt.margin]))

if (is.xts(quotes))

xts(x, time(quotes))

else x

}

The target variation margin has been set by default to 2.5%

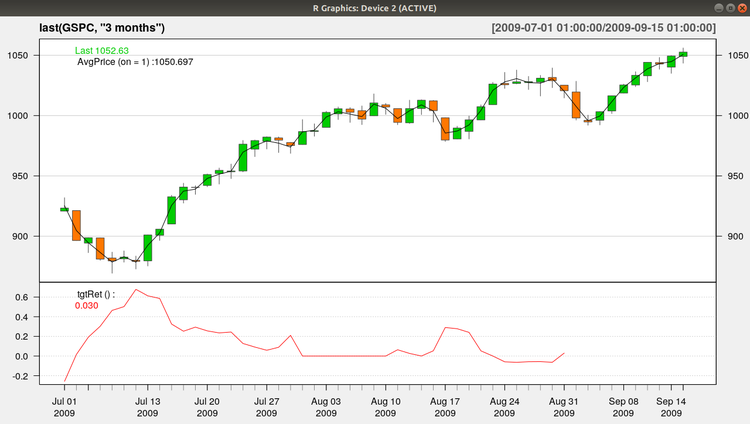

We can get a better idea of the behavior of this indicator in Figure 3.1, which was produced with the following code:

https://plot.ly/r/candlestick-charts/

https://stackoverflow.com/questions/44223485/quantmod-r-candlechart-no-colours

Esta creo que es la única librería que hace falta para esta gráfica:

library(quantmod)

> candleChart(last(GSPC, "3 months"), theme = "white", TA = NULL)

> avgPrice <- function(p) apply(HLC(p), 1, mean)

> addAvgPrice <- newTA(FUN = avgPrice, col = 1, legend = "AvgPrice")

> addT.ind <- newTA(FUN = T.ind, col = "red", legend = "tgtRet")

> addAvgPrice(on = 1)

> addT.ind()

Which Predictors?

We have defined an indicator () that summarizes the behavior of the price time series in the next k days. Our data mining goal will be to predict this behavior. The main assumption behind trying to forecast the future behavior of financial markets is that it is possible to do so by observing the past behavior of the market.

More precisely, we are assuming that if in the past a certain behavior was followed by another behavior , and if that causal chain happened frequently, then it is plausible to assume that this will occur again in the future; and thus if we observe now, we predict that we will observe next.

We are approximating the future behavior (f ), by our indicator T.

We now have to decide on how we will describe the recent prices pattern (p in the description above). Instead of using again a single indicator to de scribe these recent dynamics, we will use several indicators, trying to capture different properties of the price time series to facilitate the forecasting task.

The simplest type of information we can use to describe the past are the recent observed prices. Informally, that is the type of approach followed in several standard time series modeling approaches. These approaches develop models that describe the relationship between future values of a time series and a window of past q observations of this time series. We will try to enrich our description of the current dynamics of the time series by adding further features to this window of recent prices.

Technical indicators are numeric summaries that reflect some properties of the price time series. Despite their debatable use as tools for deciding when to trade, they can nevertheless provide interesting summaries of the dynamics of a price time series. The amount of technical indicators available can be overwhelming. In R we can find a very good sample of them, thanks to package TTR (Ulrich, 2009).

The indicators usually try to capture some properties of the prices series, such as if they are varying too much, or following some specific trend, etc.

In our approach to this problem, we will not carry out an exhaustive search for the indicators that are most adequate to our task. Still, this is a relevant research question, and not only for this particular application. It is usually known as the feature selection problem, and can informally be defined as the task of finding the most adequate subset of available input variables for a modeling task.

The existing approaches to this problem can usually be cast in two groups: (1) feature filters and (2) feature wrappers.

- Feature filters are independent of the modeling tool that will be used after the feature selection phase. They basically try to use some statistical properties of the features (e.g., correlation) to select the final set of features.

- The wrapper approaches include the modeling tool in the selection process. They carry out an iterative search process where at each step a candidate set of features is tried with the modeling tool and the respective results are recorded. Based on these results, new tentative sets are generated using some search operators, and the process is repeated until some convergence criteria are met that will define the final set.

We will use a simple approach to select the features to include in our model. The idea is to illustrate this process with a concrete example and not to find the best possible solution to this problem, which would require other time and computational resources. We will define an initial set of features and then use a technique to estimate the importance of each of these features. Based on these estimates we will select the most relevant features.

Text Mining with R - A TIDY APPROACH, Julia Silge & David Robinson

Chapter 2 - Sentiment Analysis with Tidy Data

Let's address the topic of opinion mining or sentiment analysis. When human readers approach a text, we use our understanding of the emotional intent of words to infer whether a section of text is positive or negative, or perhaps characterized by some other more nuanced emotion like surprise or disgust. We can use the tools of text mining to approach the emotional content of text programmatically, as shown in the next figure:

One way to analyze the sentiment of a text is to consider the text as a combination of its individual words, and the sentiment content of the whole text as the sum of the sentiment content of the individual words. This isn't the only way to approach sentiment analysis, but it is an often-used approach, and an approach that naturally takes advantage of the tidy tool ecosystem.

The tidytext package contains several sentiment lexicons in the sentiments dataset.

install.packages('tidytext')

library(tidytext)

sentiments

# A tibble: 27,314 x 4

word sentiment lexicon score

<chr> <chr> <chr> <int>

1 abacus trust nrc NA

2 abandon fear nrc NA

3 abandon negative nrc NA

4 abandon sadness nrc NA

5 abandoned anger nrc NA

6 abandoned fear nrc NA

7 abandoned negative nrc NA

8 abandoned sadness nrc NA

9 abandonment anger nrc NA

10 abandonment fear nrc NA

# ... with 27,304 more rows

The three general-purpose lexicons are:

- AFINN from Finn Årup Nielsen

- Bing from Bing Liu and collaborators

- NRC from Saif Mohammad and Peter Turney

All three lexicons are based on unigrams, i.e., single words. These lexicons contain many English words and the words are assigned scores for positive/negative sentiment, and also possibly emotions like joy, anger, sadness, and so forth.

All three lexicons are based on unigrams, i.e., single words. These lexicons contain many English words and the words are assigned scores for positive/negative sentiment, and also possibly emotions like joy, anger, sadness, and so forth.

- The NRC lexicon categorizes words in a binary fashion ("yes"/"no") into categories of positive, negative, anger, anticipation, disgust, fear, joy, sadness, surprise, and trust.

- The Bing lexicon categorizes words in a binary fashion into positive and negative categories.

- The AFINN lexicon assigns words with a score that runs between -5 and 5, with negative scores indicating negative sentiment and positive scores indicating positive sentiment. All of this information is tabulated in the sentiments dataset, and tidytext provides the function get_sentiments() to get specific sentiment lexicons without the columns that are not used in that lexicon.

get_sentiments("nrc")

# A tibble: 13,901 x 2

word sentiment

<chr> <chr>

1 abacus trust

2 abandon fear

3 abandon negative

4 abandon sadness

5 abandoned anger

6 abandoned fear

7 abandoned negative

8 abandoned sadness

9 abandonment anger

10 abandonment fear

# ... with 13,891 more rows

get_sentiments("bing")

# A tibble: 6,788 x 2

word sentiment

<chr> <chr>

1 2-faced negative

2 2-faces negative

3 a+ positive

4 abnormal negative

5 abolish negative

6 abominable negative

7 abominably negative

8 abominate negative

9 abomination negative

10 abort negative

# ... with 6,778 more rows

get_sentiments("afinn")

# A tibble: 2,476 x 2

word score

<chr> <int>

1 abandon -2

2 abandoned -2

3 abandons -2

4 abducted -2

5 abduction -2

6 abductions -2

7 abhor -3

8 abhorred -3

9 abhorrent -3

10 abhors -3

# ... with 2,466 more rows

How were these sentiment lexicons put together and validated? They were constructed via either crowdsourcing (using, for example, Amazon Mechanical Turk) or by the labor of one of the authors, and were validated using some combination of crowdsourcing again, restaurant or movie reviews, or Twitter data. Given this information, we may hesitate to apply these sentiment lexicons to styles of text dramatically different from what they were validated on, such as narrative fiction from 200 years ago. While it is true that using these sentiment lexicons with, for example, Jane Austen’s novels may give us less accurate results than with tweets sent by a contemporary writer, we still can measure the sentiment content for words that are shared across the lexicon and the text.

There are also some domain-specific sentiment lexicons available, constructed to be used with text from a specific content area. "Example: Mining Financial Articles" on page 81 explores an analysis using a sentiment lexicon specifically for finance.

Dictionary-based methods like the ones we are discussing find the total sentiment of a piece of text by adding up the individual sentiment scores for each word in the text.

Not every English word is in the lexicons because many English words are pretty neutral. It is important to keep in mind that these methods do not take into account qualifiers before a word, such as in “no good” or “not true”; a lexicon-based method like this is based on unigrams only. For many kinds of text (like the narrative examples below), there are no sustained sections of sarcasm or negated text, so this is not an important effect. Also, we can use a tidy text approach to begin to understand what kinds of negation words are important in a given text; see Chapter 9 for an extended example of such an analysis.

RapidMiner

Fake news detection

Paper: Fake News Detection using Machine Learning

Linguistic approach

The linguistic or textual approach to detecting false information involves using techniques that analyzes frequency, usage, and patterns in the text. Using this gives the ability to find similarities that comply to usage that is known in types of text, such as for fake news, which have a language that is similar to satire and will contain more emotional and an easier language than articles have on the same topic.

Support VectorMachines

A support vector machine(SVM) is a classifier that works by separating a hyperplane(n-dimensional space) containing input. It is based on statistical learning theory[59]. Given labeled training data, the algorithm outputs an optimal hyperplane which classifies new examples. The optimal hyperplane is calculated by finding the divider that minimizes the noise sensitivity andmaximizes the generalization

Naive Bayes

Naive Bayes is a family of linear classifiers that works by using mutually independent features in a dataset for classification[46]. It is known for being easy to implement, being robust, fast and accurate. They are widely used for classification tasks, such as diagnosis of diseases and spam filtering in E-mail.

Term frequency inverse document frequency

Term frequency-inverse document frequency(TF-IDF) is a weight value often used in information retrieval and gives a statistical measure to evaluate the importance of a word in a document collection or a corpus. Basically, the importance of a word increases proportionally with how many times it appears in a document, but is offset by the frequency of the word in the collection or corpus. Thus a word that appears all the time will have a low impact score, while other less used words will have a greater value associated with them[28]

N-grams

Sentiment analysis

Contextual approach

Contextual approaches incorporate most of the information that is not text. This includes data about users, such as comments, likes, re-tweets, shares and so on. It can also be information regarding the origin, both as who created it and where it was first published. This kind of information has a more predictive approach then linguistic, where you can be more deterministic. The contextual clues give a good indication of how the information is being used, and based on this assumptions can be made.

This approach relies on structured data to be able to make the assumptions, and because of that the usage area is for now limited to Social Media, because of the amount of information that is made public there. You have access to publishers, reactions, origin, shares and even age of the posts.

In addition to this, contextual systems are most often used to increase the quality of existing information and augment linguistic systems, by giving more information to work on for these systems, being reputation, trust metrics or other ways of giving indicators on whether the information is statistically leaning towards being fake or not.

Below a series of contextual methods are presented. They are a collection of state of the art methods and old, proven methods.