Java Desktop App - Stock Market Simulator

Contents

Project description

In this project, we have created a GUI Java (Swing) Application that simulates a trading day of a simplified model of a stock market:

- You can try the application by downloading the Java Jar file from this link: http://perso.sinfronteras.ws/images/0/00/SMSimulator.jar

- You can also see or download the Java Project from our Github repository at: https://github.com/adeloaleman/JavaDesktopApp-StockMarketSimulator

- If you just want to take a look to the Application GUI, here we show some images that try to describe the most important features of the application.

To be able to perform the simulation, the system first creates a number of companies with random values of «number of shares» and «share price». Then, we create a number of Investors with a random «budget».

Our simulator follows these rules:

- If a company sells 10 shares, the share price should double up.

- If any 10 shares are sold (from any company), and a company hasn't sold any, the price must reduce in half.

- Investors can do as many transactions as they like, but must buy only one share per transaction. Investors must try to buy shares in as many possible companies to guarantee the safety of their investment.

- The simulator should stop when all shares have been sold, or all investors have spent all their money.

The most important concepts we have applied to build this applications are:

- Design Patters:

- To facilitate communication between GUI components we have implemented a Mediator Pattern

Class diagram

Figure 1: Data example

File:SMSimulatorClassDiagram.pdf

An example of one of the classes

src/smsimulator/model/TradingDaySimulation.java

package smsimulator.model;

import java.time.LocalDate;

import java.time.format.DateTimeFormatter;

import java.util.ArrayList;

import java.util.Random;

import smsimulator.model.company.Company;

import smsimulator.model.investor.Investor;

import smsimulator.model.transaction.Transaction;

public class TradingDaySimulation {

public ArrayList<Company> companies = null;

public ArrayList<Investor> investors = null;

public ArrayList<Transaction> transactions = null;

public ArrayList<Transaction> tradingSimulator(ArrayList<Company> companies, ArrayList<Investor> investors){

ArrayList<Transaction> transactions = new ArrayList<Transaction>();

// Date of the transactions

LocalDate time = LocalDate.now();

DateTimeFormatter formato = DateTimeFormatter.ofPattern("yyyy/MM-dd");

String date = formato.format(time);

// We need this list to keep track of the total number of transactions made for each company,

// and the number of transactions made for each company every 1o transactions:

ArrayList<Integer> sharesSold = new ArrayList<Integer>();

ArrayList<Integer> sharesSoldEvery10Trans = new ArrayList<Integer>();

for (int i = 0 ; i < companies.size() ; i++){

sharesSold.add(0);

sharesSoldEvery10Trans.add(0);

}

Random r = new Random();

boolean t = true;

while (t == true){

t = false;

// We first make sure to get only the companies that have Shares:

ArrayList<Company> companiesTrans = getCompaniesWithShares(companies);

// A transaction is possible only if there are companies with Shares:

if (companiesTrans != null && companiesTrans.size() > 0){

int indexComp = r.nextInt(companiesTrans.size()); // We randomly take a company

// from the list of companies with Shares

Company comp = companiesTrans.get(indexComp);

// We get the minumum price of a share to make to know which are the investor that

// have enough money to buy a share:

double minSharePrice = getMinSharePrice(companiesTrans);

// Now we make a list with only the investors that have enough money to by a share:

ArrayList<Investor> investorsTrans = getInvestorsWithEnoughBudget(investors, minSharePrice);

if (investorsTrans != null && investorsTrans.size() > 0){ // With make sure we get investor with enough money

// At this point we have already verify that we have companies with Shares and

// investors with enough money to buy a Share. So we make our t varible = true

// to continue looping in our while statement so continue making transactions

t = true;

// Now we need a list with only the investor that have enough money to buy a share of

// the company involved in the current transaction:

ArrayList<Investor> investorsCurrentTras = getInvestorsWithEnoughBudget(investorsTrans, comp.getsharePrice());

// We make sure we get ivestor with enough money to buy a Share of the current company:

if (investorsCurrentTras != null && investorsCurrentTras.size() > 0){

// We randomly take an investor from the list of investors that have enough money to

// buy a share of tue current company:

int indexInv = r.nextInt(investorsCurrentTras.size());

Investor inv = investorsCurrentTras.get(indexInv);

// At this point we have a company with Shares and Investor with enough money to buy a Share

// So we can now make a transaction

// New transaction

transactions.add(new Transaction(inv, comp, comp.getsharePrice(), date));

// After we make a transaction, we need to set the number of shares of the current company

// so it is equal to the number of shares it had less 1, and set as well the budget of the

// investor involved in the current transaction:

companies.get(indexComp).setShares(comp.getShares() -1);

investors.get(indexInv).setBudget(inv.getBudget() - comp.getsharePrice());

// Vectors to keep track of the total number of transactions made for each company

// and the number of transactions each 10 transactions.

sharesSold.set(indexComp, sharesSold.get(indexComp)+1);

sharesSoldEvery10Trans.set(indexComp, sharesSoldEvery10Trans.get(indexComp)+1);

// Now we apply the rules that have been asked:

// If a company sells 10 shares, the share price should double up:

if (sharesSold.get(indexComp) != 0 && sharesSold.get(indexComp) % 10 == 0) {

companies.get(indexComp).setSharePrice(comp.getsharePrice()*2);

}

// When any 10 shares are sold (from any company), and a company hasn't sold any,

// the price must reduce in 2%.

if (sumAll(sharesSold) != 0 && sumAll(sharesSold) % 10 == 0){

for (int i = 0 ; i < companies.size() ; i++){

if (sharesSoldEvery10Trans.get(i) == 0){

double price = companies.get(i).getsharePrice();

double newPrice = price - price*0.02;

companies.get(i).setSharePrice(newPrice);

}

else{

// sharesSoldEvery10Trans.set(i, 0);

}

}

}

}

}

}

}

return transactions;

}

public ArrayList<Company> getCompaniesWithShares(ArrayList<Company> companies){

ArrayList<Company> c = new ArrayList<Company>();

for (int i = 0 ; i < companies.size() ; i++){

if (companies.get(i).getShares() > 0){

c.add(companies.get(i));

}

}

return c;

}

public ArrayList<Investor> getInvestorsWithEnoughBudget(ArrayList<Investor> investors, double minBudget){

ArrayList<Investor> inv = new ArrayList<Investor>();

for (int i = 0 ; i < investors.size() ; i++){

if (investors.get(i).getBudget() >= minBudget){

inv.add(investors.get(i));

}

}

return inv;

}

public double getMinSharePrice(ArrayList<Company> companies){

double minSharePrice = companies.get(0).getsharePrice();

// Declare min and max elements index as 0 (i.e. first element)

int minIndex = 0;

// Iterate through ArrayList

for(int i = 1; i < companies.size(); i++ ){

// If current value is less than min value, it is new minimum value

if (companies.get(i).getsharePrice() < minSharePrice){

minSharePrice = companies.get(i).getsharePrice();

minIndex = i;

}

}

return minSharePrice;

}

public int sumAll(ArrayList<Integer> numbers){

int sum = 0;

for (int number : numbers){

sum += number;

}

return sum;

}

}

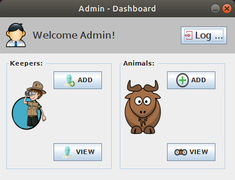

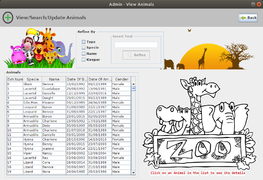

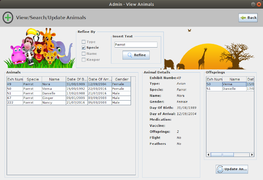

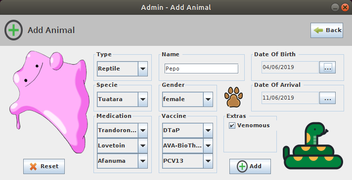

A look at the GUI

Assignment Introduction

You have been asked to design and implement a simulator of a simplified model of a stock market.

The program is going to simulate both companies and investors, following the specific requirements described below.

When the simulation has been completed, you must present the user a menu with a list of possible reports for them to see the result.

Specific Requirements

- The system must create dynamically 100 companies. All of them must have:

- A unique ID

- A random number of shares (between 500 and 1000)

- A random share price (between 10 and 100)

- Any other attribute that you consider relevant to the context

- The system must create dynamically 100 investors. All of them must have:

- A unique ID

- Arandom budget between 1000 and 10000

- Any other attribute that you consider relevant to the context

- Once all the companies have been created, the simulator should run a "trading day". This will run transactions were investors buy shares in the companies that exist, following the rules below:

- If a company sells 10 shares, the share price should double up.

- If any 10 shares are sold (from any company), and a company hasn't sold any, the price must reduce in half.

- Investors can do as many transactions as they like, but must buy only one share per transaction. Investors must try to buy shares in as many possible companies to guarantee the safety of their investment.

- The simulator should stop when all shares have been sold, or all investors have spent all their money.

- You are required to present the user with a menu to display the result of the simulation, with the following options:

- Company with the highest capital(number of shares times share price).

- Company with the lowest capital (number of shares times share price).

- If there are more than one company at the top or bottom position, they all should be displayed in the result.

- Investor with the highest number of shares.

- Investor that has invested in the most companies.

- Investor with the lowest number of shares.

- Investor that has invested in the least number of companies.

- It there is more than one investor in any of the positions, they all should be displayed in the result.

- At least three design patterns must be implemented in your project.

Extra marks

If you would like to achieve a distinction consider adding some extra layers of functionality, such as, but not limited to:

- Implementing data persistency through a file or external database, or any other aspect that might be relevant to the context.

- Implementation of a multi threaded environment to simulate several investors trading at the same time.

- Other reports such as total number of transactions.